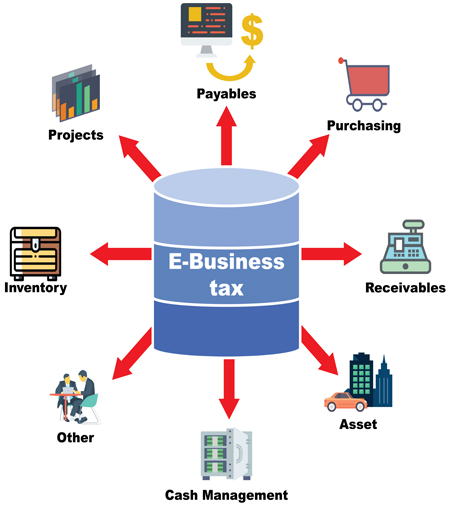

Oracle E-Business Tax

Oracle E-Business Suite( and Oracle Fusion) customers in India and the GCC (Gulf cooperation council) countries have to comply with the recently introduced tax regimes like GST (Goods and Services Tax) and VAT (Value Added Tax) respectively.

Most Oracle E-Business Suite customers in India depend on the Oracle Financials for India (India Localization) for rolling out the Goods and Services Tax introduced from July 2017.

Some of you might even be aware that it is possible to configure the Oracle Global Tax engine (E-Business Tax) for complying with the Goods and Services Tax.

The Oracle EBS (and Fusion) customers in the GCC countries would need to configure the Global E-Business Tax engine to comply with the recently introduced Value Added Tax.

Bazaar247 could help you rapidly roll out the eBTax (Oracle E-Business Tax) for the respective GST or VAT regimes as may be the requirement.

Bazaar247 has pre-configured solution templates for the various countries like India, UAE, Oman, Kingdom of Saudi Arabia, Bahrain and any other GCC countries.

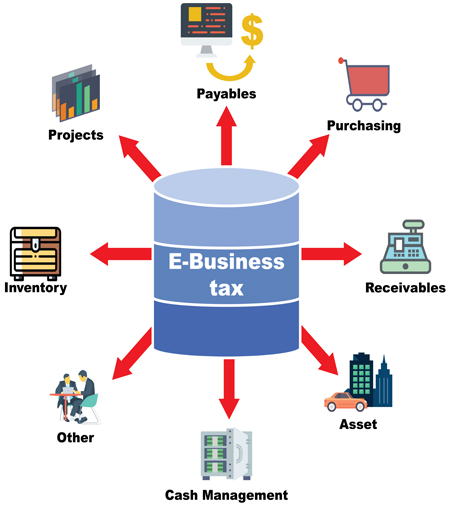

Oracle E-Business Tax

Oracle E-Business Suite( and Oracle Fusion) customers in India and the GCC (Gulf cooperation council) countries have to comply with the recently introduced tax regimes like GST (Goods and Services Tax) and VAT (Value Added Tax) respectively.

Most Oracle E-Business Suite customers in India depend on the Oracle Financials for India (India Localization) for rolling out the Goods and Services Tax introduced from July 2017.

Some of you might even be aware that it is possible to configure the Oracle Global Tax engine (E-Business Tax) for complying with the Goods and Services Tax.

The Oracle EBS (and Fusion) customers in the GCC countries would need to configure the Global E-Business Tax engine to comply with the recently introduced Value Added Tax.

Bazaar247 could help you rapidly roll out the eBTax (Oracle E-Business Tax) for the respective GST or VAT regimes as may be the requirement.

Bazaar247 has pre-configured solution templates for the various countries like India, UAE, Oman, Kingdom of Saudi Arabia, Bahrain and any other GCC countries.

Bazaar247 has carried out the complete automation of the Tax Solution using eBTax for a customer in the Retail segment.

The entire roll out could be carried out in a matter of 4 to 6 weeks.

The best part is that we were ready with the solution for GST even before Oracle had started releasing the patches for the Oracle Financials for India (India Localization).

The customers would then have a question – Would this be supported by Oracle?

The Global E-Business Tax engine is a fully supported solution and any configuration done using the eBTax would be supported by Oracle subject to the appropriate support licenses.

Your Organization

The GST requirements would vary depending on the nature of your industry. A Manufacturing Organization or a Trading Organization would deal with Goods as well as Services, whereas an Organization delivering Services might not deal extensively with Goods.

Your Organization

The GST requirements would vary depending on the nature of your industry. A Manufacturing Organization or a Trading Organization would deal with Goods as well as Services, whereas an Organization delivering Services might not deal extensively with Goods.

Pre-Configured Solution

Tax is determined by countries that collect the tax. Bazaar247 has developed a Tax model thatis line with the various tax categories and rates as stipulated by the tax regimes. We have built the model on Oracle eBTax module for various countries like India, GCC Countries like UAE, KSA, Bahrain etc. that provides an 80% to 90% fit right out of the box! This can be rolled out without any major changes to your existing EBS system.

Bazaar247 has mapped the GST/VAT and the tax rates introduced by the respective Tax authorities to pre-configured taxes using simple naming conventions.

Pre-Configured Solution

Tax is determined by countries that collect the tax. Bazaar247 has developed a Tax model thatis line with the various tax categories and rates as stipulated by the tax regimes. We have built the model on Oracle eBTax module for various countries like India, GCC Countries like UAE, KSA, Bahrain etc. that provides an 80% to 90% fit right out of the box! This can be rolled out without any major changes to your existing EBS system.

Bazaar247 has mapped the GST/VAT and the tax rates introduced by the respective Tax authorities to pre-configured taxes using simple naming conventions.

User Training

The Pre-configured solution is installed / configured on a Test /Development instance and the users are trained on the various maintenance activities that they would have to carry out as and when the need arises.

User Training

The Pre-configured solution is installed / configured on a Test /Development instance and the users are trained on the various maintenance activities that they would have to carry out as and when the need arises.

Iterative Changes

Based on feedback from the Users, any changes or fine tuning of the configuration is carried out on the Test/Development instance. Custom reports in excel or csv formats are developed to address the local statutory requirements.

Iterative Changes

Based on feedback from the Users, any changes or fine tuning of the configuration is carried out on the Test/Development instance. Custom reports in excel or csv formats are developed to address the local statutory requirements.

User Testing

Users then test the end to end transactions for the defaulting of the taxes on various transactions. They also carry out the verification of the Accounting entries generated.

Production

Once the Solution is tested by the users and signed off, it is rolled out to Production.

Production

Once the Solution is tested by the users and signed off, it is rolled out to Production.

Let’s deliver the right solution for your business